Your digital business toolkit 🇧🇪

Starting a business in Belgium, whether it’s a commercial company, a self-employed activity like a freelance, or a not-for-profit association (ASBL), is an exciting project.

Starting a business in Belgium, whether it’s a commercial company, a self-employed activity like a freelance, or a not-for-profit association (ASBL), is an exciting project.

However, the path can seem full of administrative, tax and legal pitfalls. Fortunately, the Belgian authorities have developed some remarkable online portals to guide you, and some of them are also available in English.

Here’s a guide to some essential websites you should know about and keep in your favourites (together with Finest Consult, of course).

They will guide you from the initial idea right through to the day-to-day running of your business, providing an overview about key organisations to be familiar with.

1. The central portal: Guichet d’Entreprises

What is it?

The Guichet d’Entreprises is the single entry point for all business start-ups in Belgium. This is where it all starts. This portal allows you to set up your business in a single operation, by registering with all the necessary authorities.

These business service centres are entities approved (recognised) by the Belgian government. Their mission is to assist entrepreneurs with the administrative procedures involved in setting up and managing their businesses.

In addition to the mandatory administrative formalities, business service centres can offer a range of additional services designed to facilitate the launch and development of a business.

When you register, a Guichet d’Entreprises helps you deal with fundamental steps such as:

- Registration with the Crossroads Bank for Enterprises (CBE or BCE in French).

- VAT registration with the Federal Public Service Finance.

- Membership of a social insurance fund for the self-employed (if applicable).

- Notification to the parastatal body responsible for your sector.

This can be considered the heart of Belgian business administration.

Web address: www.entreprise.fgov.be

2. The tax control tower: Federal Public Service FPS Finance

What is the FPS Finance?

The FPS Finance is the federal tax administration. Its site is a mine of information on all the taxes your company will have to deal with.

You’ll find all the information you need on:

- VAT (Value Added Tax): Schemes, declarations, periodic returns (monthly/quarterly), deductions.

- Personal Income Tax (IPP) or Corporation Tax (IS): Calculation, rates, annual returns.

- Withholding tax (the equivalent of withholding tax on salaries).

- Tax credits: for research and development, innovation, culture, employment, etc.

The site also provides access to online services such as “My Minfin” for managing your tax affairs.

Read the latest news from FPS Finance

Web address: finances.belgium.be

3. The social partner: National Social Security Office (ONSS)

What is the ONSS?

The ONSS is the body that manages social security for salaried workers. As soon as you take on your first employee, it becomes your main contact.

What does ONSS do?

- Social security contributions: Calculation, declaration and payment of social security contributions due on your employees’ wages.

- Immediate declarations of employment (DIMONA): Mandatory for all new hires.

- Periodic multifunctional declarations (DMFA): A single social declaration that brings together all the information on your staff and their remuneration.

Even as a self-employed person, you contribute to a “social insurance fund”, which is a private body approved by the INASTI (the National Social Insurance Institute for the Self-Employed), linked to this system.

Official website: www.onss.fgov.be

4. The economic compass: National Bank of Belgium (NBB)

What is it?

The NBB is much more than the central bank. It houses the Central Balance Sheet Office, a database containing the annual accounts of almost all Belgian companies.

This site is essential for:

- Filing your annual accounts: All companies (SA, SPRL/SCS, etc.) are required to file their annual accounts with the Central Balance Sheet Office.

- Analysing the financial health of your competitors, customers or suppliers.

- Downloading templates for preparing your annual accounts in accordance with Belgian standards.

This is a tool for financial transparency and a legal obligation for most organisations.

Web address: www.nbb.be

5. Regional Agencies

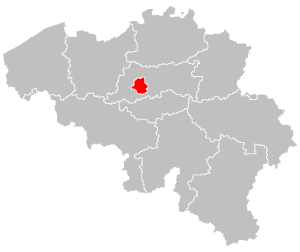

As Belgium is a federal state, the Regions (Brussels-Capital, Wallonia, Flanders) have extensive powers to support businesses.

These regional agencies are your contacts for all matters relating to direct economic aid.

What do they manage?

- Subsidies and bonuses for investment, employment and innovation.

- Strategic advice and personalised support.

- Guarantees for bank loans.

- Export support.

Web addresses for each region:

- Brussels: economie-emploi.brussels (hub.brussels)

- Wallonia: www.usance.be (AWEX for exports) and www.uccw.be (Union des Classes Moyennes de Wallonie)

- Flanders: www.vlaio.be

6. For the no profit world: FPS Interior

What is it?

The FPS Interior is the supervisory authority for ASBLs and other not-for-profit associations in Belgium.

Its website is vital for:

- Understanding the legal obligations specific to NPOs (general meeting, board of directors).

- Accessing model articles of association.

- Managing publications in the Moniteur belge (official announcements).

- Consulting the rules on assets and ancillary commercial activities.

Website: www.ibz.be (see “Associations and foundations”)

A Complete Guide to Belgian E-Services from the SPF Finances: For Individuals and Businesses

Simplify your administrative and tax procedures in Belgium with the digital tools of the SPF Finances and the expertise of Finest Consult.

The digitalization of the Belgian administration has fundamentally changed how taxpayers interact with the state. Today, the vast majority of tax and patrimonial obligations are managed online through the various portals of the SPF Finances (Federal Public Service Finance). Whether you are a local resident, an international company operating in Belgium, or a foreign investor, mastering these digital tools is essential for compliance.

In this comprehensive guide, Finest Consult provides an overview of the key e-services, their purpose, who they are for, and how to access them. Our accounting and tax firm is here to help you navigate these often complex interfaces with ease.

1. MyMinfin: Your Central Personal Tax Portal

MyMinfin is the primary entry point for almost all interactions with the Belgian tax authorities.

- What is it for? A secure platform that centralizes your entire tax and patrimonial file. You can consult your tax returns, documents, official correspondence, outstanding debts, and register your bank accounts.

- Who can access it? All citizens (residents and non-residents) as well as legal representatives of companies.

- How to access: Visit MyMinfin using your electronic ID card (eID) with a card reader or via the itsme® application.

2. Income Tax Declarations: Tax-on-web and Biztax

Tax-on-web (IPP/PIT)

This is the most widely used tool for individuals in Belgium for their annual personal income tax return.

- What is it for? Filing and submitting your annual tax return electronically. It often features a “Simplified Tax Proposal” for straightforward cases.

- Who can access it? Private individuals, employees, self-employed persons (sole traders), and non-residents.

- How to access: Directly through the Tax-on-web portal.

Biztax

The specialized platform dedicated to corporate taxation.

- What is it for? Filing corporate income tax (CIT/ISOC), legal entities tax (IPM), and non-resident corporate tax returns.

- Who can access it? Belgian companies, non-profit organizations, and foreign branches.

- How to access: Via Biztax. Access requires secure authentication (eID or itsme®) by a company representative or a mandated professional like Finest Consult.

3. Managing VAT: Intervat and VIES

Intervat

Value Added Tax (VAT) management is a critical component of any commercial activity in Belgium.

- What is it for? Filing periodic VAT returns, intra-community statements, and the annual client listing.

- Who can access it? Any individual or legal entity registered for VAT in Belgium.

- How to access: Through Intervat. Note that due to the complexity of deductibility rules, professional assistance is highly recommended.

VIES (VAT Number Validation)

- What is it for? A tool to verify the validity of VAT numbers for business partners within the European Union.

- Who can access it? Any business engaged in cross-border transactions.

- How to access: Via the European Commission website or the VIES link.

4. Real Estate and Patrimony: CadGIS and Lease Registration

CadGIS

- What is it for? A mapping application that allows users to consult cadastral data, including property boundaries and parcel plans.

- Who can access it? Property owners, notaries, architects, and anyone interested in Belgian land registry data.

- How to access: Visit CadGIS.

MyRent (Lease Registration)

- What is it for? Officially registering a rental contract (lease), which is a legal requirement in Belgium for residential properties.

- Who can access it? Landlords and tenants.

- How to access: Using the MyRent application within the MyMinfin portal.

5. Mandatory Registrations: UBO Register and Withholding Tax

UBO Register

- What is it for? The “Ultimate Beneficial Owners” register. Its purpose is to identify the natural persons who ultimately own or control a company or non-profit (ASBL/VZW).

- Who can access it? It is mandatory for all legal entities registered in Belgium to update this annually.

- How to access: Via the UBO Register portal. Failure to comply can result in significant administrative fines.

FinProfit (Withholding Tax on Movable Property)

- What is it for? Declaring the withholding tax due on dividends or interest payments.

- Who can access it? Companies distributing profits to shareholders.

- How to access: Through the FinProfit application.

Why use an expert to manage your Belgian e-services?

While these tools are designed to be accessible, their use carries significant legal and financial responsibility. An error in a Biztax filing or a missed deadline on Intervat can trigger tax audits or heavy late-payment penalties. Furthermore, the Belgian tax code is one of the most complex in the world.

By appointing an expert from Finest Consult, you delegate the technical and administrative burden while optimizing your tax position. We act as your official mandate holder, ensuring that all submissions are accurate, secure, and submitted on time.

Do you need specialized accounting and tax expertise in Belgium?

Managing your tax obligations should not be an obstacle to your growth. Finest Consult is your trusted partner for navigating the Belgian administrative landscape.

We provide specialized services for:

- Individuals: Tax optimization, income tax returns, and estate planning.

- Companies: Full bookkeeping, VAT compliance, Corporate Tax (ISOC), and strategic business advisory.

- International Clients: Assistance for expats and foreign companies looking to establish or maintain a presence in Belgium.

Our multidisciplinary team provides personalized services in French (FR), English (EN), and Italian (IT).

Contact the experts at Finest Consult today for a tailored consultation and professional peace of mind.

Other useful websites for your business

- Hub.Brussels – Agency for Entrepreneurship

- Swift / BIC banking code search

- List of NACE-BEL codes

- Belgium.be – Official public websites

- Statbel – National statistics institute

- Eurostat – Statistics and Data on Europe

- European VAT number search / EU VIES

- Electronic invoicing system PEPPOL (compulsory from 2026)

- International tax agreements concerning Belgium

- Brussels-Capital Region official website

- Tax accountant Brussels

- Open a company in Belgium

- Calculate net salary after tax in Belgium

- Digital marketing agency Brussels

- itsme secure identification app for iOS and Android

Main organisations related to work and social security in Belgium

In Belgium, several public and semi-public bodies structure the professional and social lives of employees, self-employed persons (professionals, freelancers, independents), companies (snc, src, sa, etc.), coops, and associations (ABSL).

In Belgium, several public and semi-public bodies structure the professional and social lives of employees, self-employed persons (professionals, freelancers, independents), companies (snc, src, sa, etc.), coops, and associations (ABSL).

Belgian social security system

The social security system is coordinated at federal level by the National Social Security Office (ONSS / RSZ), while the Regions and Communities manage employment and certain local assistance schemes.

For the self-employed, the social insurance fund (social insurance fund for self-employed workers) is a key player: membership is compulsory and it collects social security contributions that give access to basic protection (pension, family allowances, health and disability insurance, etc.).

Its “customers” are self-employed persons, whether full-time or part-time, carers and company directors, who can choose between different approved funds, often linked to a social secretariat or a business service centre.

Mutual insurance companies (mutuelles)

At the same time, all salaried and self-employed workers must join a mutual insurance company (mutualité / mutuelle de santé), such as a Christian, socialist (Solidaris), liberal or neutral mutual insurance company, which reimburses part of the cost of healthcare and provides cover in the event of incapacity for work, with basic cover being compulsory for anyone working in Belgium.

Belgian trade unions

The Belgian trade unions (FGTB/ABVV, CSC/ACV, CGSLB/ACLVB) represent workers, negotiate collective agreements, defend individual rights and, for the unemployed, act as benefit payment agencies in collaboration with the National Employment Office (ONEM/RVA), which manages the unemployment insurance scheme at federal level and monitors the conditions for granting benefits. Registration for workers is optional.

Employment

Each Belgian Region has its own dedicated public employment service: VDAB (Vlaamse Dienst voor Arbeidsbemiddeling en Beroepsopleiding) in Flanders, Actiris in Brussels, Le Forem in Wallonia and ADG for the German-speaking Community (located within Wallonia).

These organisations assist job seekers (registration, job offers, guidance, training) and support employers with recruitment, hiring subsidies and skills needs analysis.

Social assistance

In the field of social assistance, the CPAS / OCMW (Public Social Welfare Centres) offer a safety net for anyone residing in Belgium who does not have sufficient means, for example through the right to social integration, housing assistance, emergency medical assistance or comprehensive social support.

The CPAS work in conjunction with social security and the ONEM, for example for people who are moving from integration income to unemployment benefits (chômage) or vice versa.

For organisations

For entrepreneurs, NGOs, associations and companies, social insurance funds, mutual insurance companies, regional employment services, the ONEM, the ONSS, as well as economic information services such as the FPS Economy or regional development agencies, form a dense institutional ecosystem that is useful to know in order to best manage social status, recruitment, legal obligations and access to public aid.

If you need help understanding the Belgian system or dealing with tax or administrative matters, please contact us.

Itsme app installation guide (video)

Itsme is a mobile identity application that allows citizens of Belgium and a number of other European countries to connect to government platforms (like My Minfin), banks (KBC, ING, Belfius, BNP Paribas, Argenta, etc.), insurers and other private companies (phone, utilities, etc.).

itsme® is a secure, free digital identity app for smartphones used in Belgium to log in, sign documents, and share data with government and private sector services.

Itsme acts as a digital key, replacing the need for card readers or passwords for online services, and links your electronic identity card and phone number to create a secure PIN-based authentication system.

The mobile app is highly popular for its ease of use and security, allowing users to access a wide range of services, from government platforms to online banking

In fact, itsme can also be used to share identity data, confirm payments and sign digitally (qualified electronic signature under the European eIDAS regulation).

Looking for a multilingual tax accountant in Belgium?

We serve individuals and organisations, taking care of any aspects.