In-depth analysis of salaries in Belgium: beyond the gross figures

Brussels, Belgium: Talking about salaries in Belgium is like opening a book on economics, geography, and society all at once.

Behind the famous “median salary” lies a complex and fascinating reality.

The profile of the Belgian salary

If we were to draw a portrait of the average Belgian worker, they would earn a median net salary of around €2,600 per month (after taxes and social security contributions). This figure, more representative than the average, means that half of workers earn more, and the other half less.

In gross terms, the average salary hovers around €3,800. But these figures are just a starting point. According to the crowdsourcing site Numbeo, the average net salary in Brussels was about €3,050 in 2025.

Recent figures indicate that Belgium’s GDP per capita was €44,800 in 2023, €47,430 in 2022 and €43,800 in 2021. According to Eurostat, Belgium ranks sixth in the European Union in terms of GDP per capita with €44 800, well above the EU average (€38 100). The country accounts for 3.5% of the EU’s total GDP.

A fluctuating trend

In recent years, purchasing power has been a major concern. Faced with inflation, the government implemented a protective mechanism: automatic wage indexation.

When prices rise too high, wages follow almost automatically. This unique safeguard in Europe has helped preserve purchasing power, even if the feeling of erosion remains strong in the minds of many households.

Belgium on the European stage: a paradox

Compared to its neighbors, Belgium presents an interesting paradox. A high gross salary can seem less attractive once taxed, with one of the highest rates in the OECD. This is what is known as the “tax wedge”. However, the magic happens when you look at purchasing power.

Thanks to a robust social system (healthcare, unemployment benefits – limited to a maximum of two years starting in 2026, etc.) and decent net wages, Belgians consistently rank among the European champions in this area. You may earn less “on paper” than in the Netherlands or Germany, but in everyday life, your euro often carries more weight.

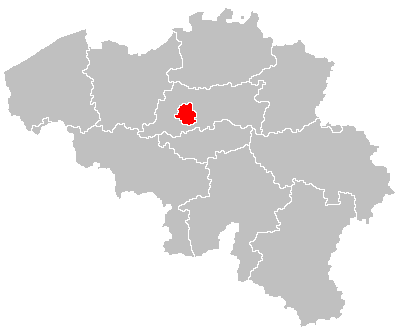

The major disparities: Brussels, Flanders and Wallonia

The salary map in Belgium is not uniform. There is a marked regional divide. The Flemish Region and, to a lesser extent, Brussels-Capital, boast higher salaries than Wallonia.

This gap is explained by the concentration of company headquarters, high-value-added industries, and economic dynamism in the north of the country. Even within the three regions, the disparities between cities (Antwerp, Ghent, Liège, Charleroi) and rural areas are also very real.

The Belgian job market offers a certain degree of security and a good standard of living, but it is characterized by high taxes and very different realities depending on whether you work in Antwerp, Namur, or the European capital. It’s a uniquely Belgian balance, in a way.

Cost of living in Belgium according to Numbeo (2026)

- The estimated monthly costs for a family of four are 3,618€, excluding rent.

- The estimated monthly costs for a single person are 1,012€, excluding rent.

- Cost of living in Belgium is, on average, 0.8% lower than in the USA and 18% lower than in London, UK.

- Rent in Belgium is, on avg., 43% lower than in United States and 53% lower than in London.

NL: Netto salariscalculator na belastingen in België.

Brussels, Belgium: Talking about salaries in Belgium is like opening a book on economics, geography, and society all at once.

Brussels, Belgium: Talking about salaries in Belgium is like opening a book on economics, geography, and society all at once.